Introduction

First Solar is a very strong company with a lot of potential to grow because of its strong fundamentals

Fundamentals

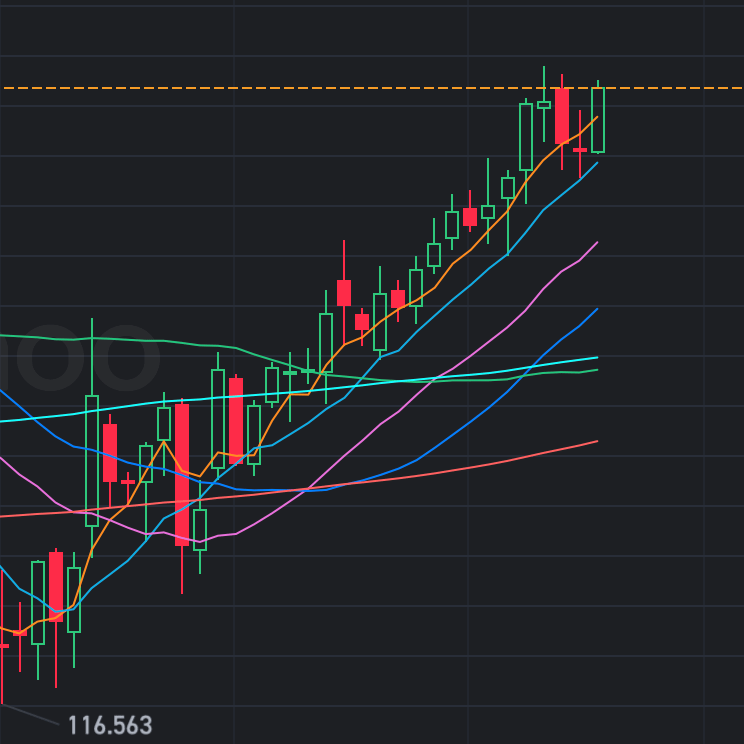

First Solar is up quite a bit, and retreats aren’t uncommon after large gains. There’s a good chance that First Solar will experience the typical see-sawing we see with stocks, and you can pick up shares a bit cheaper over the next few weeks, but I expect the price swings to be relatively minor. The stock has a really steady climb as seen below. FSLR revenue growth is about 15% (YOY) and a 29% (TTM) net income margin. After Q3 results were announced in October, revenue growth jumped to around 31% and the net income margin jumped to 28%. First Solar’s growth and profit margins are both increasing, so for this calculation, I increased revenue growth to 15% (over 10 years) and the next income at 20%. While the net income margin is currently much higher, I believe over time it will moderate a bit.

Valuation

First Solar’s current market value is around $29–30 billion, and projecting forward to 2026 yields a range based on different macro and industry conditions. In a base-case scenario of steady solar demand and consistent execution, its total worth could reasonably fall in the $30–$35 billion range. If conditions are more favorable—strong utility-scale solar growth, smooth factory expansions, and robust free-cash-flow gains—First Solar could reach a bull-case valuation of roughly $40–$50 billion, with the upper end approaching $50–$55 billion if investors price the stock near optimistic DCF estimates. Conversely, in a bear case where demand softens or margins tighten, the company’s market value might stay near or slip toward $20–$25 billion. Overall, the most balanced expectation places First Solar’s 2026 valuation in the $35–$45 billion range, assuming neither extreme headwinds nor exceptional tailwinds.

Concerns for The Industry

The risk of solar panels is that they are not the most consistent source of energy. Even though the sun produces ten thousand times the energy our entire population uses in a year there are still other limitations. For example there are sunnier days and cloudier days resulting in a problem if we are to reliant on solar panels. Also there are parts of the world like Seattle that receive less sunlight than Florida. Also the most efficient solar panels can only harvest around 45% of the actual energy the sun produces while a commercial solar panel can only harvest from 15-20%.

Conclusion

In conclusion, First Solar is a very strong company with great fundamentals and can be evaluated much higher in the future based on other data. Even thought there are some disadvantages for this industry it still remains a strong buy for me.